Summary:

In this episode of Be a Smarter Homeowner, hosts Beth Dodson and John Bodrozic explore how AI technology is transforming the way homeowners prepare for severe weather events. They discuss how HomeZada now uses AI to deliver real-time alerts based on your exact property location — not just your city or zip code — helping you act faster when dangerous weather is on the way.

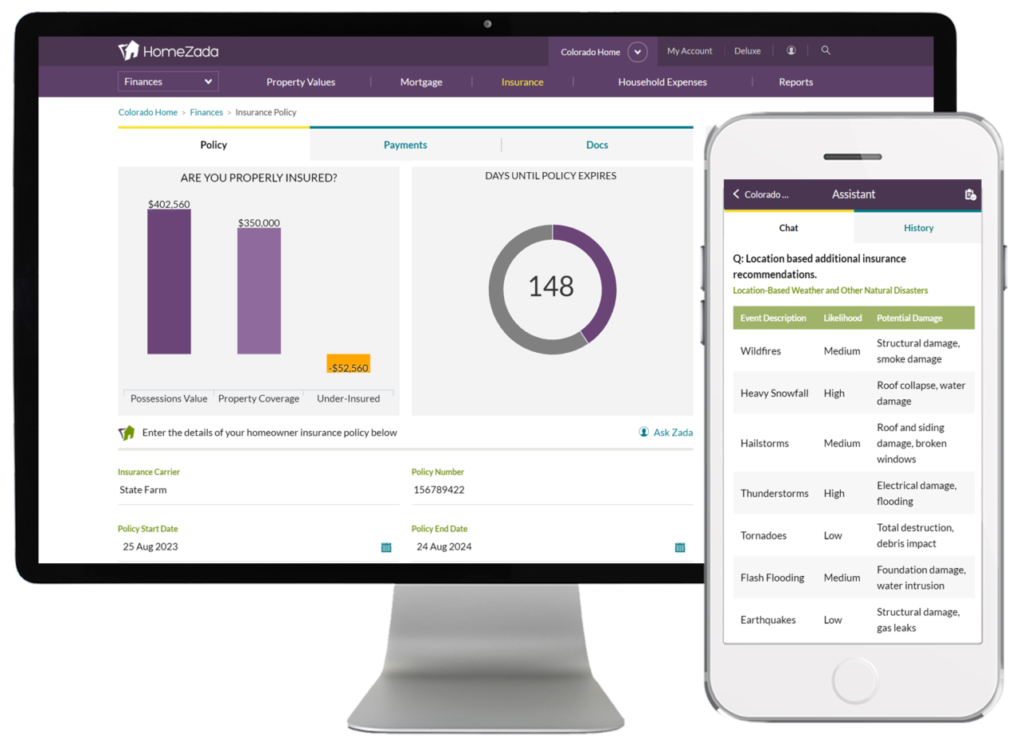

Beth and John walk through how the system pulls data from the National Weather Service, translates it into specific, actionable recommendations, and even helps homeowners proactively assess risks like floods, wildfires, hurricanes, hailstorms, and high winds before disaster strikes. They explain how the AI goes beyond just warnings — offering preparation advice, emergency kit checklists, and even insurance insights tailored to your region.

Whether you’re new to an area, unfamiliar with local weather patterns, or just busy with everyday life, this episode shows why early preparation is critical — and how smarter tools can help you protect your home, your property, and your family. If you’ve ever wondered what more you could be doing to be ready for the unexpected, this episode is packed with real solutions.

Keywords

HomeZada, AI, severe weather, homeowner tips, weather alerts, home safety, property protection, emergency preparedness, National Weather Service, homeowner education, emergency preparedness, AI weather alerts, home insurance, disaster risk assessment, homeowner education

Takeaways

- AI integration enhances homeowner awareness and preparedness.

- Severe weather alerts are crucial for protecting property and family.

- Different regions experience different types of severe weather.

- Homeowners should understand the specific risks in their area.

- Proactive measures can mitigate damage from severe weather.

- The National Weather Service categorizes weather events by severity.

- HomeZada provides personalized weather alerts based on location.

- Real-time alerts can guide immediate actions during severe weather.

- Preparation for severe weather should be ongoing, not just reactive.

- Evacuation is the top priority during severe weather emergencies.

- Create a three-day supply of water for each person.

- AI can provide personalized recommendations based on location.

- Timely alerts can help homeowners take quick action.

- Stringing together technologies enhances preparedness.

- Homeowners need to understand their insurance coverage.

- Proactive measures can minimize disaster risks.

- AI tools can assess disaster risks for specific homes.

- Homeowners should regularly review their insurance policies.

- Understanding local weather patterns is crucial for homeowners.

- AI can provide more data than traditional insurance providers.

Sound Bites

- “The home is a complex entity.”

- “Find a way to get your family safe.”

- “Getting ahead of it is important.”

- “Do you own an emergency generator?”

- “How would the claims process work?”

- “Prepare for financial resiliency.”

Chapters

00:40 Introduction to Home Disasters

01:51 Understanding Different Types of Disasters

06:55 Evacuation Planning and Safety

10:46 Protecting Your Property

15:51 Insurance and Home Inventory

21:55 Living Without Utilities

26:06 Final Thoughts on Preparedness