Owning a home has so many components that keep us on our toes, but one of the aspects of a home that is extremely valuable are the details surrounding the finances about a home. Remembering what you paid for your home and what its current appraised value is is important to the overall improvement in your home and your personal equity. Understanding what your annual maintenance costs and annual expenses can also help you identify trends on how to better predict your spending for years to come. If you start seeing trends in increases for specific costs, then as an aware homeowner you can make the best decisions on your spending, your vendors and your care and use of your home.

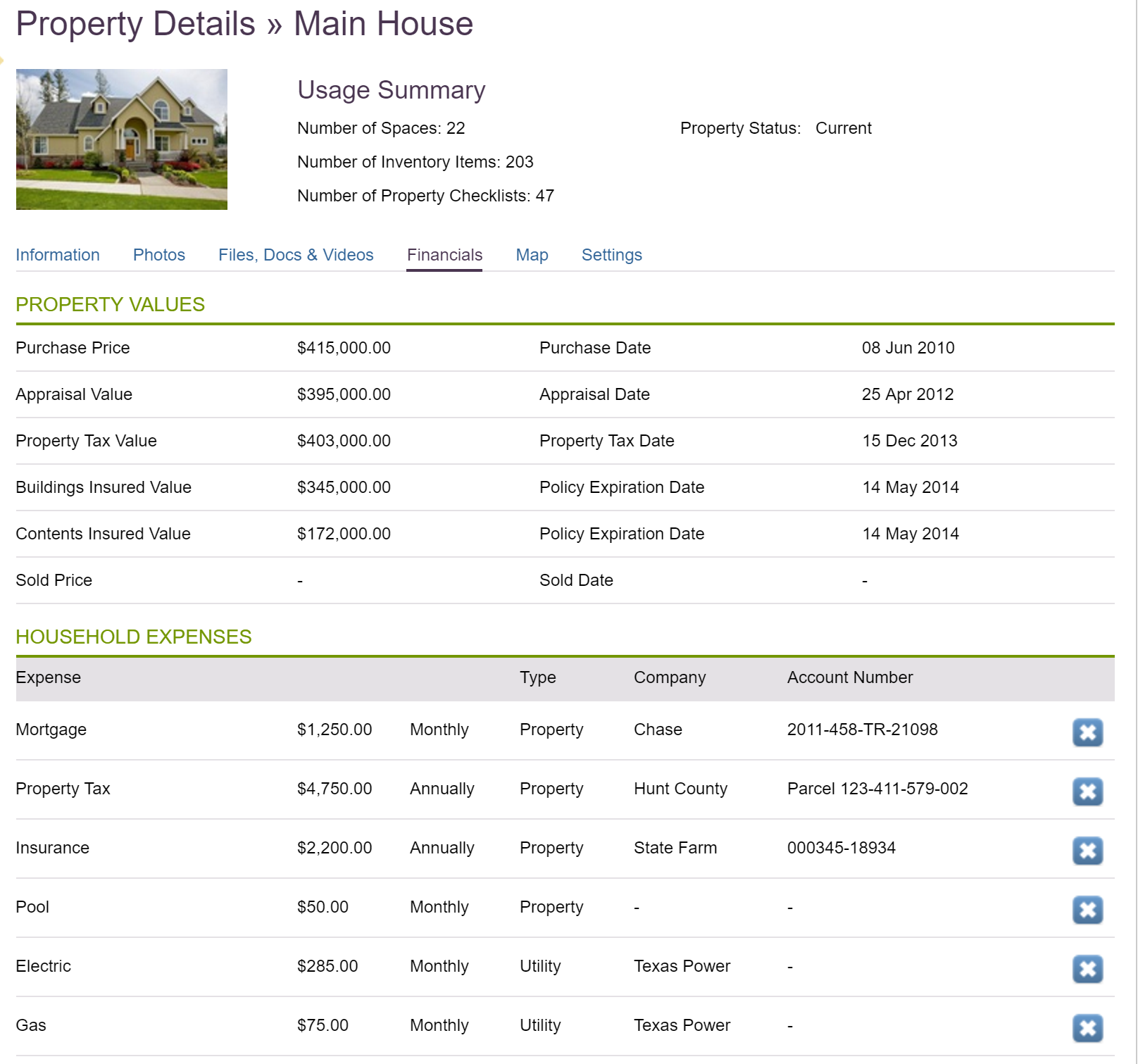

HomeZada has financial functionality that allows you to track all the necessary financial details of your home. Track purchase price, appraisal value and understanding what your insurance will cover in case you need to file a claim. Understanding your household expenses can help any homeowner better manage their monthly cashflow.

Tracking what you own in your home in the form of creating values for your items while crafting your home inventory. These financial details can help provide value to where the most expensive areas of the home in order to add additional security or to provide visibility to where the most contents or the most valuable contents are in your home. Understanding your contents will also help you understand how much you have spent over years furnishing your home.

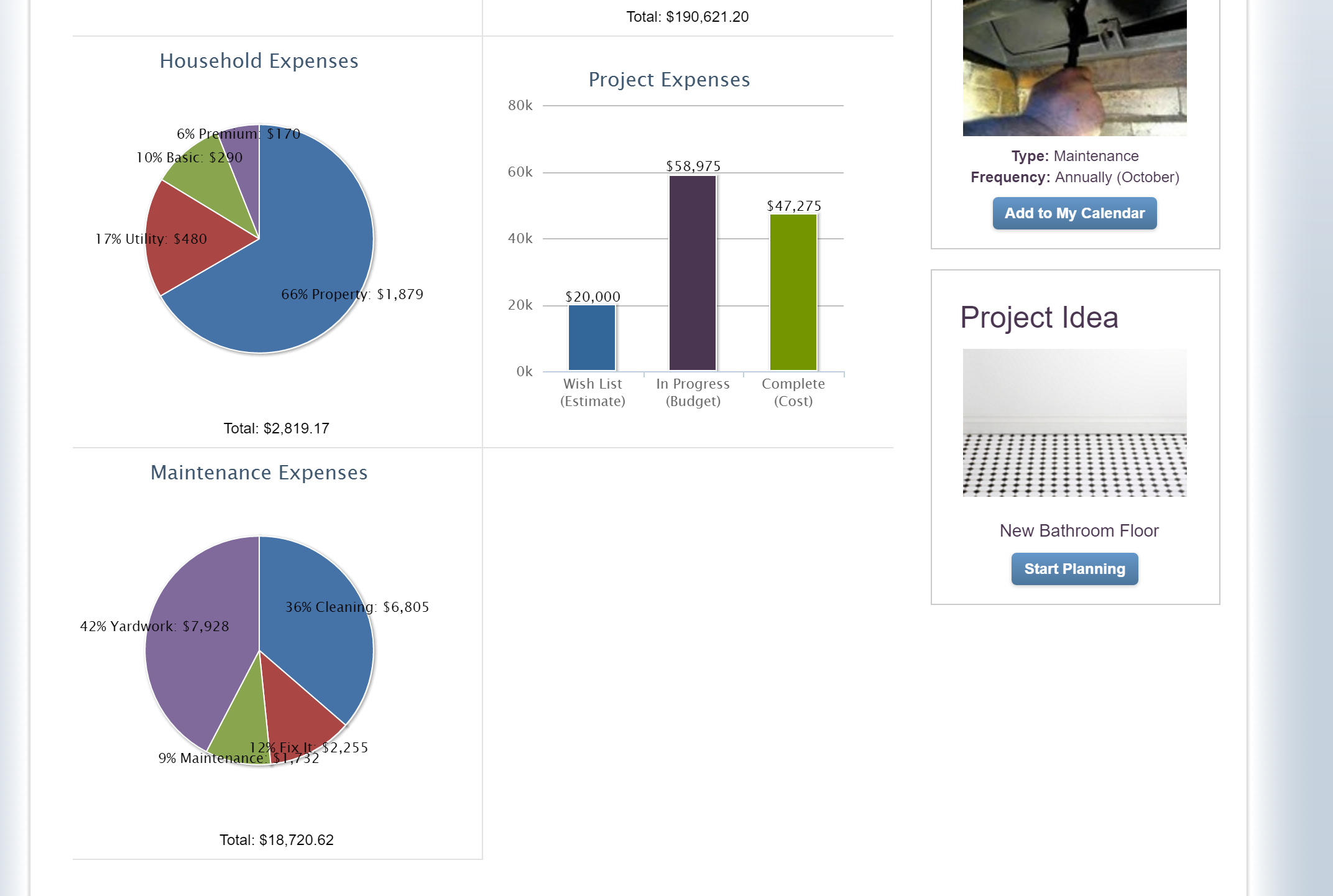

Many people are more visual in nature and viewing financial data in graphical outputs like bar charts and pie charts can be found in HomeZada Premium. We believe in good data inputting into HomeZada will be produce great graphs to help any homeowner make the best decisions.

Tracking household and project expenses can help anyone manage their cash flow, budgets and spending. Managing these details can also help homeowners properly plan for the future