If you’re feeling the squeeze of monthly payments, it can feel like you’re on a hamster wheel. In this blog, we’ll explore practical strategies to help you conquer your financial challenges and pave the way to a debt-free future.

Get the “lay of the land”

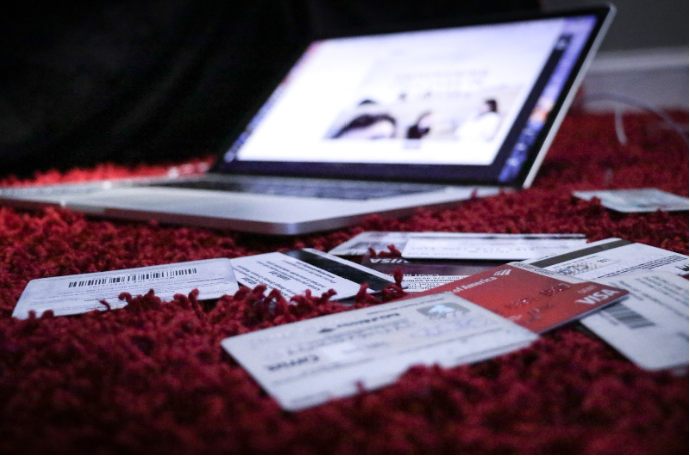

Not all debts are created equal. Mortgages and student loans are considered investments in your future. On the flip side, credit card debt is a financial black hole. Understanding this distinction sets the stage for effective debt management.

Sit down, grab a cup of coffee (save the wine for when you’re done), and lay out all your debts. Knowing the enemy is half the battle. To achieve debt freedom, you must accurately calculate interest rates and total balances and analyze your monthly cash flow. This is a crucial first step towards achieving your financial goals.

Pick your mortgage repayment strategy(ies)

Owning a home is a dream come true for many, but it often comes with a heavy financial burden in the form of a mortgage. The thought of paying off a mortgage can feel overwhelming, but there are ways to make it more manageable.

Common ways to beat the mortgage (definition: death pledge) blues…

- ⬥Extra mortgage payments

- ⬥Refinancing

- ⬥Government assistance programs (if applicable to your situation)

Tackle other debts

Student loans, car loans, and credit cards – oh my! You should also try to negotiate with your lender for friendlier terms. Two common methods to destroy your debt include either the snowball or the avalanche method.

Here’s an overview:

- ⬥The debt snowball method prioritizes debts based on the outstanding balance, aiming to create momentum through quick wins and psychological boosts.

- ⬥The avalanche method prioritizes debts based on interest rates, aiming to minimize the overall interest paid, which can lead to cost savings in the long run.

Snowball method

The debt snowball method is a powerful debt reduction strategy that thrives on the psychology of small wins. This approach focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation that propels individuals towards larger financial victories.

Here’s how it works:

Let’s meet Sarah, who has three debts: a $500 medical bill, a $1,000 credit card balance, and a $5,000 car loan. Instead of aiming to pay off the car loan first due to its larger size, Sarah decides to focus on the $500 medical bill. She pays off the medical bill in just three months by cutting unnecessary expenses and allocating an extra $200 each month.

Now debt-free on the medical bill, Sarah takes the $200 she used to tackle it and redirects it to the credit card debt. With her new snowball payment of $300 ($100 minimum amount + $200 from the medical bill), she swiftly eliminates the $1,000 credit card balance in four months.

The debt snowball gains momentum as Sarah now throws the entire $300 towards her car loan. With dedication and consistency, she eradicated the $5,000 car loan in less time than she initially thought possible.

The beauty of the debt snowball method lies in its ability to provide quick wins. By eliminating smaller debts first, individuals experience a sense of achievement and motivation. This positive reinforcement fuels the determination to tackle larger debts, fostering a sustainable momentum that keeps the snowball rolling.

While the debt snowball method may not be the most financially optimal strategy for interest savings, its psychological benefits make it an attractive option for many. The sense of progress and accomplishment can be a game-changer, propelling individuals toward a debt-free future with confidence and momentum on their side.

Avalanche method

In the avalanche method, debts are prioritized based on their interest rates. The debt with the highest interest rate is tackled first, followed by the one with the next highest interest rate, and so on.

This method is designed to minimize the total interest paid over the life of the debt. It is a financially strategic approach that may result in overall cost savings, especially when dealing with high-interest debts.

For example, if you have debts with interest rates of 20%, 10%, and 5%, you would start by paying off the debt with a 20% interest rate, then move on to the 10% debt, and finally the 5% debt.

Which one should you choose?

The debt snowball method prioritizes debts based on the outstanding balance, aiming to create momentum through quick wins and psychological boosts.

However, the avalanche method prioritizes debts based on interest rates, aiming to minimize the overall interest paid, which can lead to cost savings in the long run.

Ultimately, the choice between the debt snowball and avalanche methods depends on individual preferences, financial goals, and the importance placed on psychological motivation versus financial optimization.

Some may prefer the quick wins of the snowball method, while others may opt for the long-term cost savings offered by the avalanche method.

How to get started

- ⬥Find space in your budget for debt repayment

- ⬥Build your emergency fund

- ⬥Seek professional guidance if needed

Staying motivated

The road to financial freedom is a marathon, not a sprint. Celebrate small victories, create milestones, and track your progress.

Remember, it’s not about perfection; it’s about progress. Implement these strategies, stay motivated, and watch your financial future transform into a tale of triumph and freedom!

How Inventory Software Can Keep Your Debt Reduction Plan on Track

Buying Your First Home: Here Is A 10 Point Checklist You Need to Go Over