There is a universal phrase that “Nothing is really free.” What this means is that if you think you are getting something for free, it is actually costing you somewhere else or you are giving up something else up in order to get that product or service for free.

Read MoreHomeZada Launches Payment Tracking Features and Integrates with Banking Apps

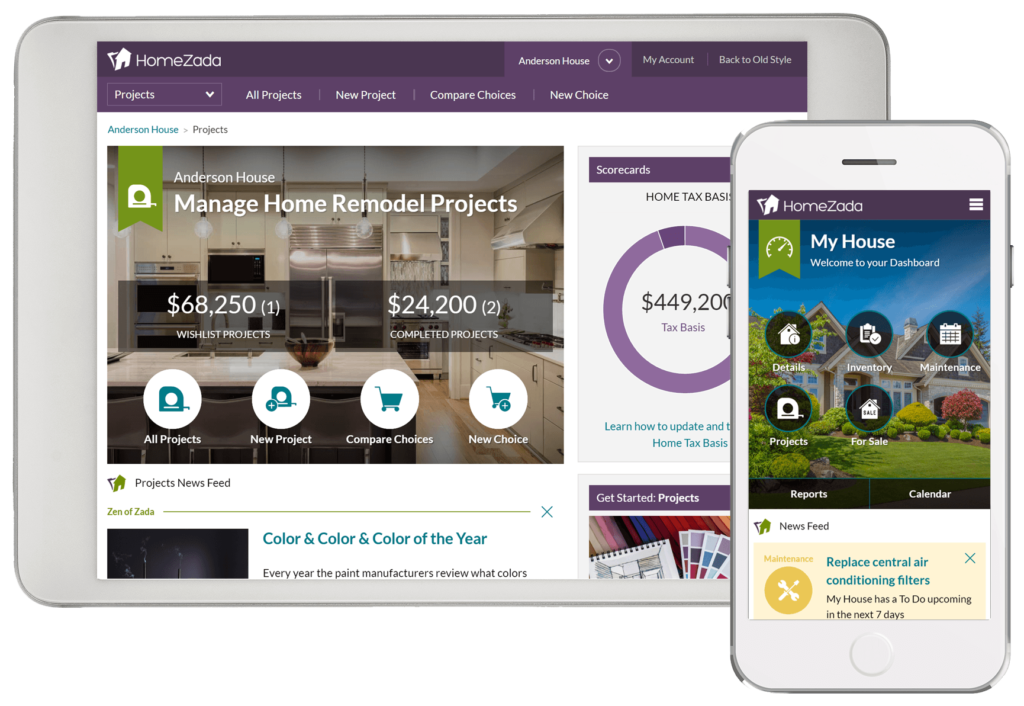

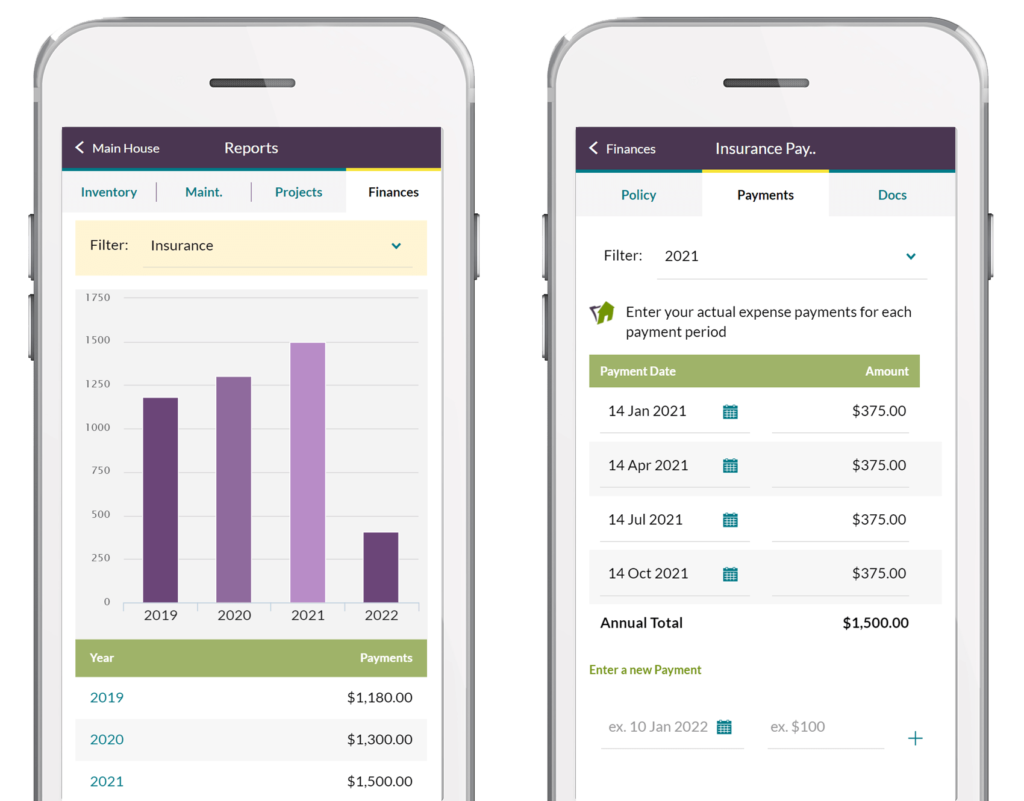

HomeZada enhances its home finances features by adding the ability to track all actual costs and payments for your household expenses. You can track all actual payments including your mortgage, insurance, property tax, utilities, basic and premium home services. These new features compare actual payment costs to HomeZada’s budget amounts for each individual expense and all your home related expenses.

Read MoreEp 009 – What to Expect as a First Time Homeowner

SHOW NOTES:

When it comes to homeownership, first-time homeowners often have challenges. These challenges often surround home maintenance. Understanding the types of home maintenance that are necessary to manage a home and why home maintenance is important to keeping a home operating properly. If as a first-time homeowner, you need to hire someone to help with these tasks, how do you contract and interview these service providers? What can first-time homeowners look for when it comes to home management? Listen as John and Beth share their experience and tips for first-time homeowners.

IN THIS EPISODE:

● [01:46] Things first-time homeowners will need to be aware of

● [04:38] Types of maintenance first-time homeowners should be aware of

● [08:26] Smart home technology pros and cons

● [13:06] Costs for managing a home

● [18:40] Finding the right professionals to help with home maintenance

● [22:52] Paying attention to small inconsistencies in your home

● [26:43] First-time homeowner action items

KEY TAKEAWAYS:

● No matter what your age, no matter what generation you’re in, no matter where you live, you still struggle with the same things as a first-time homeowner.

● The specifics of maintenance fall into five categories: seasonal maintenance; maintaining the health of your home, like air quality; maintenance that keeps your home safely functioning; energy efficiency maintenance; and outdoor maintenance

● Preventive maintenance is extremely important in avoiding unexpected maintenance costs.

● When hiring maintenance professionals, first-time homeowners can utilize helpful platforms like Angie’s List, Porch, or others to find high quality professionals.

● Action step: Create a schedule for preventive home maintenance

LINKS MENTIONED:

www.homezada.com

BIO:

Elizabeth Dodson is a focused technology entrepreneur with successful skills in business development, sales, marketing, and finance with over 20 years of successful management of revenue producing partners. With great organizational skills balancing multiple roles and responsibilities as an entrepreneur and the drive to increase company revenues and user growth for a consumer technology solution with a partner solution to support the homeowner market.

John Bodrozic has start-up entrepreneur experience beginning with boot strapping, profitable growth, securing venture and corporate venture funding, acquisitions of technology companies, and selling a business to a publicly traded company.

Ep 007 – Stay on Top of Home Finances

SHOW NOTES:

In today’s episode, John and Beth talk about home finances. Which includes more than just the aspects of buying or selling a home. We discuss the financial nuances of home buying, but we also talk about the importance of tracking and managing ongoing finances as a homeowner. We break down common homeowner’s expenses, how to prepare for them and save money, why you should keep track of the value of your home, and ultimately, how to make smarter financial decisions related to your home.

IN THIS EPISODE:

● [02:06] Home finances related to buying a home

● [03:25] Closing costs and down payments

● [04:10] Understanding and tracking your investment

● [11:23] Home equity assets

● [12:49] Home inventory assets

● [14:35] Regular ongoing home expenses

● [18:59] How do you budget for ongoing home expenses?

● [23:23] Maintenance/repair expense

● [25:33] Hiring people for infrequent maintenance

● [28:40] How do you budget for these expenses

● [30:06] Home improvement expenses

KEY TAKEAWAYS:

● Your mortgage amount, down payment, and closing costs are all things to keep in mind when buying a home.

● Having title insurance is important because you want to protect the property that you’re buying, and title insurance does do that. It helps identify the long history of where the property was once purchased.

● Action Step: After you buy your home and move in, track how your estimated value of your home is increasing.

● Calculating your home equity is a simple equation. It’s the estimated value of your home minus the remaining balance on your mortgage. That’s the percentage that you own.

● The two most important ways that you can increase your equity is you live in a hot neighborhood and the value is going up and you’re paying off your mortgage.

● Regular home expenses include mortgage and insurance, utilities, service providers, lawn care, maintenance contractors, property taxes.

● It’s important to track what the market thinks your home is worth and what your county thinks your home is worth, which is how your property taxes are assessed based on.

● Action Step: Commit to creating a budget for home expenses (regular, annual, and irregular), track the actuals and then use that to make better smarter decisions in the future.

● Your home maintenance may be 1 to 4% of the total purchase price of your home. 1% if your house is less than five years old but once your house gets between five and 15 years old, that percentage increases to 2%.

LINKS MENTIONED:

How to Prepare Your Home for a Refinance Appraisal

Need to refinance? Your lender may require a home appraisal before approving any changes in financing.

As a homeowner, you’ll obviously want to get the highest appraisal you can to ensure that you’re able to secure the amount of financing you need.

While you have no direct control over what the market says your home is worth, it is within your power to do everything you can to get the best appraisal possible.

Read More