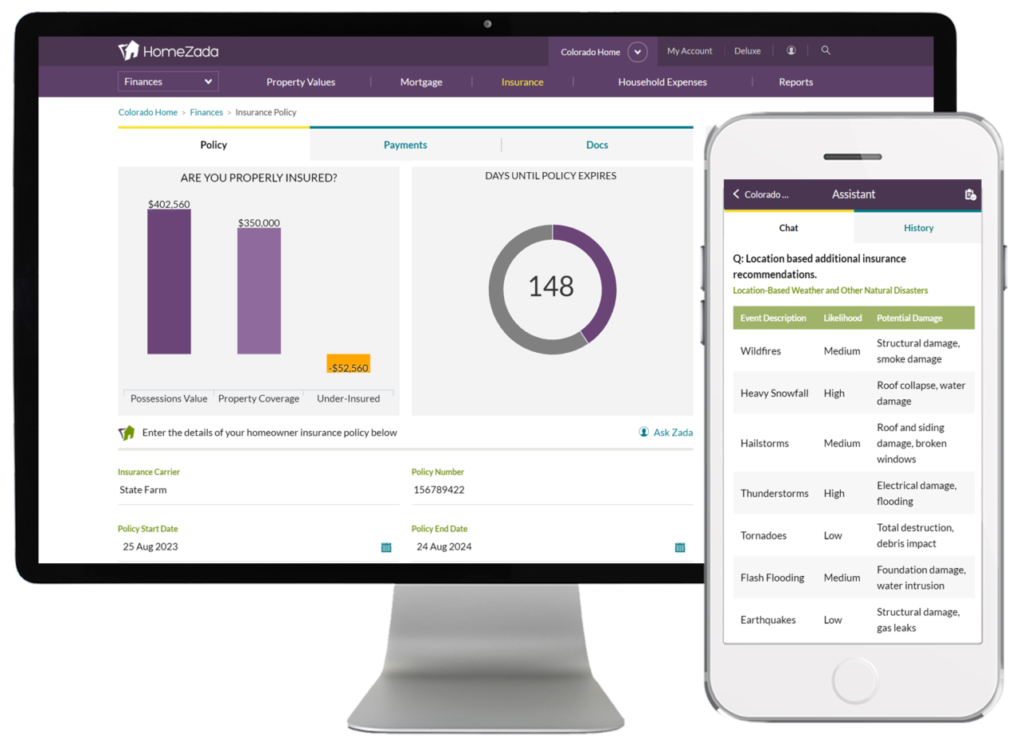

Every homeowner across the country faces different climate and weather risks. The latest release of HomeZada’s Ai allows each user to get an overall assessment of multiple weather risks based on their unique property address. The risk assessment provides a prioritized list based on the likelihood of the weather event happening along with a description of how your home could be damaged as a result.

Read MoreHome Warranties vs. Home Insurance: Understanding the Difference

Consider your home a big investment, like a really expensive car. Just like you need insurance for your car, your home needs protection, too. There are two main ways to protect your home: Home Warranties and Home Insurance. They might sound similar, but they’re pretty different. Let’s break it down in simple terms so you can figure out what’s best for your house.

Read MoreDo You Have Enough Insurance on Your Home? Here’s How to Know

Homeowner’s insurance is a “necessary evil” that comes with owning a home, especially if you have a mortgage.

You pay it every year, either as part of your mortgage or when the bill comes in the mail. But, God forbid, if you were to have a loss, would your policy be enough to cover what happened?

Read MoreDo You Have Enough Insurance Coverage on Your Second Home?

Your primary home insurance provides financial security by insuring your house, possessions, and assets. Homeowners’ insurance for a second home does the same.

The primary distinction is that second homes typically have higher home insurance rates due to a higher risk of claims.

The same coverage is included in homeowner’s insurance for second homes as for your primary residence, but due to the higher risk of insurance claims, vacation homes are typically more expensive to insure.

Read MoreHow to Choose the Right Homeowners Insurance

Compared to all the time and effort that goes into buying a house or apartment, many homeowners tend to leave the question of insurance on the backburner. However, picking the right kind of coverage is crucial for safeguarding your assets in the case of a major disaster or burglary.

Additionally, if you’re going to be taking out a loan to purchase your new home, mortgage companies will require you to have some form of coverage.

Read More