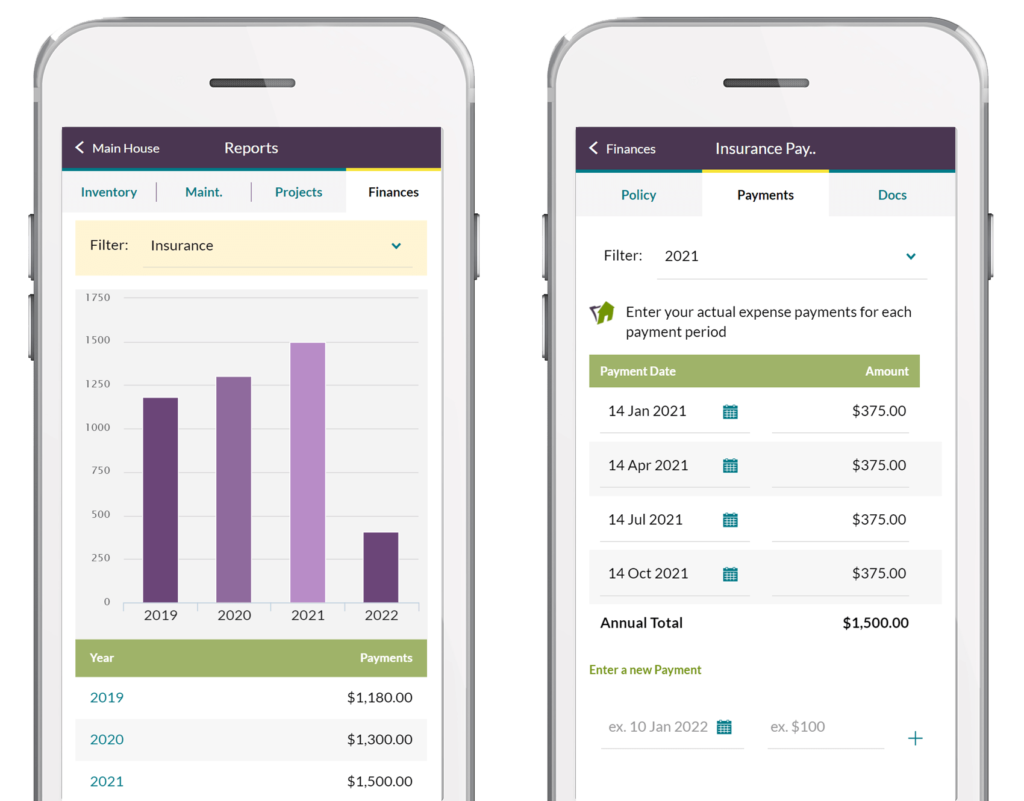

HomeZada enhances its home finances features by adding the ability to track all actual costs and payments for your household expenses. You can track all actual payments including your mortgage, insurance, property tax, utilities, basic and premium home services. These new features compare actual payment costs to HomeZada’s budget amounts for each individual expense and all your home related expenses.

Benefits

Homeowners and professionals who manage multiple properties benefit from these features by gaining more financial awareness over the actual costs to own or manage a specific property. These features also help with any payment disputes you might have with a vendor or service provider. Another benefit is the ability to spot multi-year trends so you can save money by either changing your usage patterns with your home or switching providers of various home related services.

Some examples are tracking variable usage expenses such as your gas, electric and utility bills. These payments go up and down with the cold and hot seasons as your heating and cooling increases and decreases with each month. Seeing this payment data helps you devise ways to make your home more energy efficient and to change your behavior on how you use these utilities. Another example is multi-year trends of insurance rates and property taxes. Tracking how these costs change over multiple years helps you decide whether to switch to other vendors or negotiate with your current provider.

Payment Approaches

Option 1

The payments feature is easy to use with three different approaches. One is simply clicking on any home finance expense, selecting the “Payments” tab and entering in the date, description, and the amount. You can even go back in previous years to enter in previous payments to see these long-term trends.

Option 2

An even easier way to get payment data is to import from a .csv file that you can export from your bank where you make your home payments. Most online banking and credit card applications allow you to export a month, or a quarter, or even a years’ worth of transactions to a .csv file. HomeZada allows you to easily import these payment transactions and assign them to your various household expenses. Once you create an initial “match” on your first import, all your subsequent imports are extremely easy because the matches are done for you. You can import a year’s worth of home related transactions in just a few clicks which gives you that instant financial visibility.

Option 3

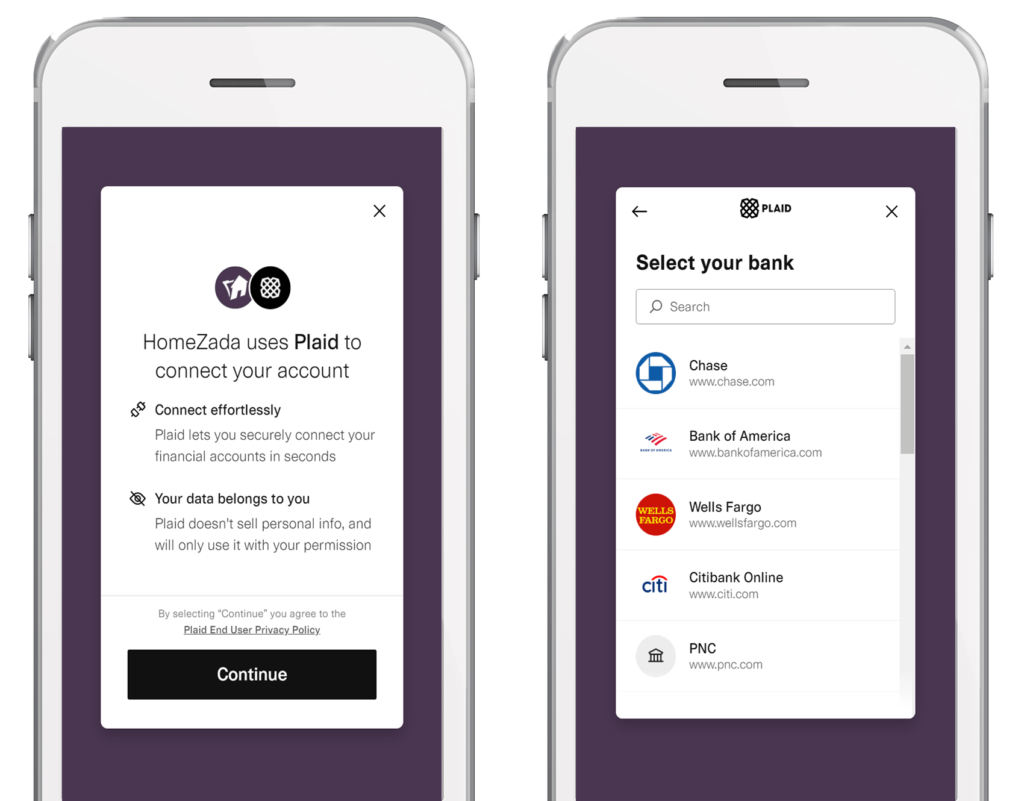

The third approach is the most automated where you securely connect your HomeZada account to your online bank and/or credit card accounts. You periodically initiate a “Synch” which automatically exports actual payments from your bank and imports into HomeZada in one step. Then you create the “match” rules to assign payments to expenses which makes all your subsequent “Synchs” even more automated. HomeZada’s bank synching features support most banks and credit cards in the US.

Rental Income Details

For our customers who generate rental income from either their primary home or from dedicated rental properties, you can also use the payments feature to track the actual rent payments you receive. Professional users of HomeZada such as property managers can also use the new payments features to track their expenses from service providers to the property and the income they receive from their clients.

We want to thank our many customers who have been asking us for these new payment features. We are committed to making HomeZada the best digital home management platform and many of the great ideas come directly from you.

For more information on these new set of features, please review this video.

Know your home’s finances in one simple step with HomeZada

2 Responses to “HomeZada Launches Payment Tracking Features and Integrates with Banking Apps”