Every homeowner across the country faces different climate and weather risks. The latest release of HomeZada’s Ai allows each user to get an overall assessment of multiple weather risks based on their unique property address. The risk assessment provides a prioritized list based on the likelihood of the weather event happening along with a description of how your home could be damaged as a result.

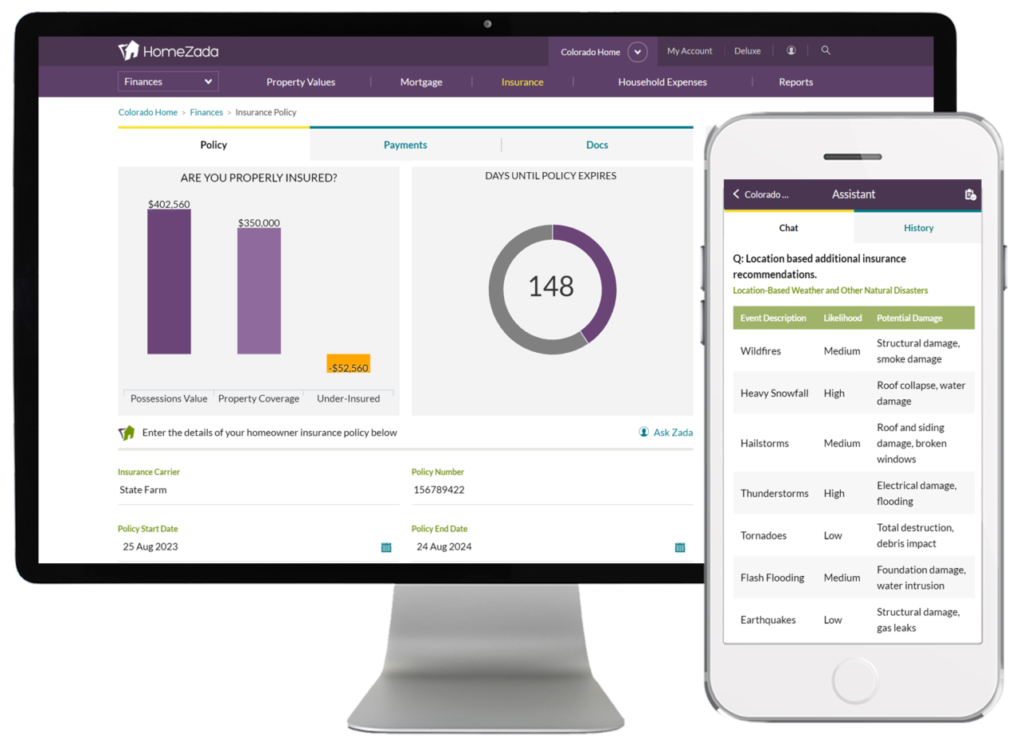

HomeZada customers can go to the Insurance page under the Finances section and just click on the “Ask Zada” text links on the page. Based on your property address, Zada Ai returns expert information for homeowners to consider in protecting their home.

Geographical Risk

Many homeowners move to new states, and they don’t understand the climate and weather risks their homes face. Zada Ai assesses risk such as wildfires, floods, earthquakes, landslides and more in the west coast. Tornados, hail, freezing rain, lighting strikes in the Midwest. Hurricanes, tornadoes, storm surge, sinkholes, floods and more in the southeastern US. The mountain and northeastern part of the United States experience blizzards, ice storms, high winds, and more.

Additional Insurance

Many homeowners are not aware that certain weather risks are not included in a standard home insurance policy. Zada Ai provides a list of additional insurance coverage options based on your address and the associated risk factors. It even tries to provide an estimate of additional costs that homeowners can consider if they want additional insurance. This is advanced insurance expertise at homeowners’ fingertips.

Assess Standard Policy Coverages

HomeZada’s insurance page helps homeowners track the coverage amounts in their standard policy. If homeowners click on “Ask Zada” in this section, the Zada Ai will provide recommendations on how much insurance coverage is appropriate for dwelling structure, personal property, other structures, liability and more. Ask Zada also provides knowledge on typical high value categories that require additional coverage that are not included in standard policies.

Knowledge is King

Many homeowners do not understand the various aspects of their home insurance policies. Ask Zada and the Ai technology in combination with each specific property address gives consumers more knowledge to have a smarter discussion with their insurance company.

Of course, Zada Ai is just a technology tool and we recommend every homeowner verify the information that is produced by engaging in direct conversations with your insurance provider. HomeZada’s goal is to empower all homeowners to be more knowledgeable about how to manage and protect their home, and to make sure they are on the same page as the companies they use to provide insurance protection.

HomeZada Launches AI Vision for Easiest and Most Powerful Home Inventory Application

Do You Have Enough Insurance on Your Home? Here’s How to Know