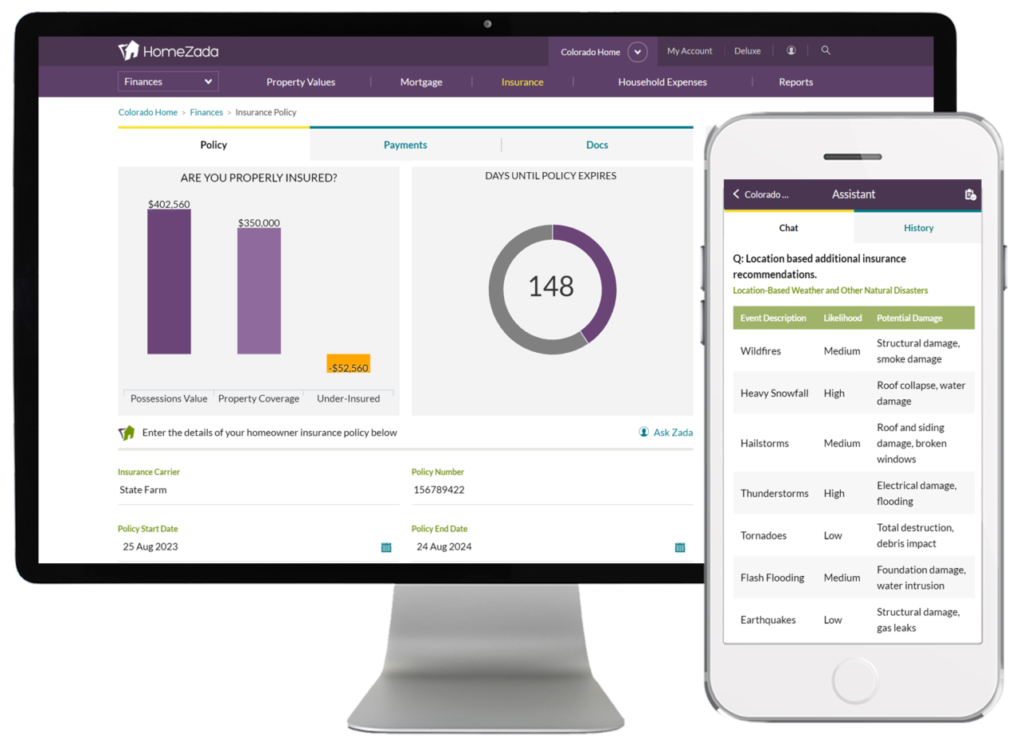

Every homeowner across the country faces different climate and weather risks. The latest release of HomeZada’s Ai allows each user to get an overall assessment of multiple weather risks based on their unique property address. The risk assessment provides a prioritized list based on the likelihood of the weather event happening along with a description of how your home could be damaged as a result.

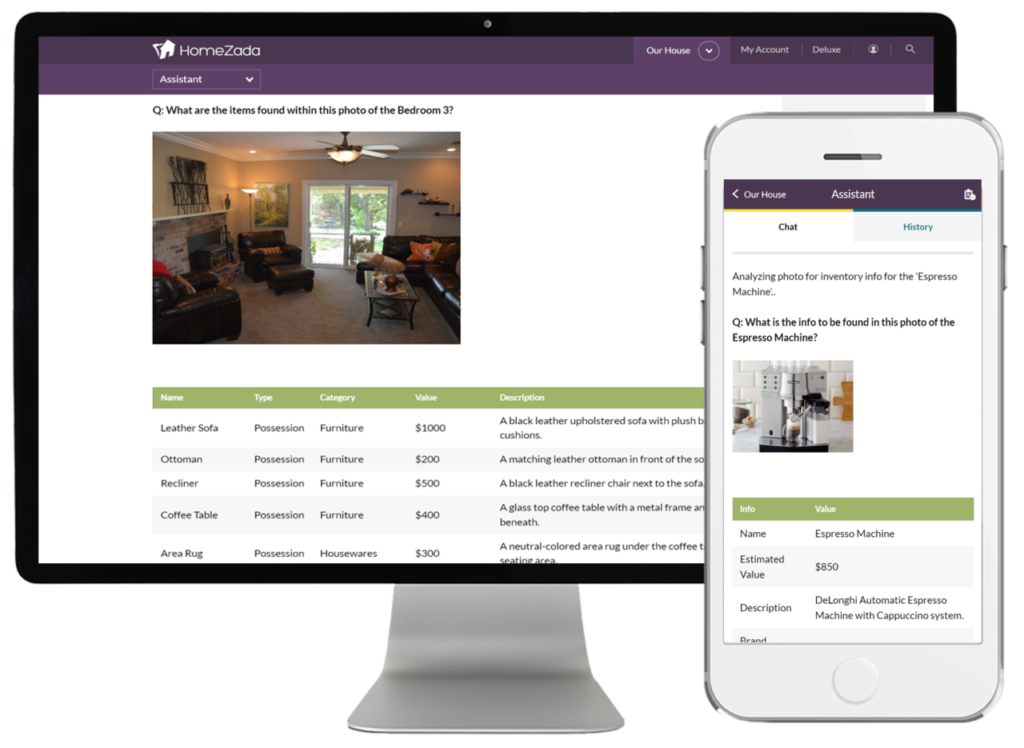

Read MoreHomeZada Launches AI Vision for Easiest and Most Powerful Home Inventory Application

A new release of HomeZada uses AI to make creating a home inventory much quicker and more accurate. Each photo can be processed using Zada AI which visually detects multiple objects in the photo and estimates the value of each item. Zada AI also detects text on close up photos of objects such as electronics, appliances, equipment and anything that has a serial number.

Read MoreHow Inventory Software Can Keep Your Debt Reduction Plan on Track

Keeping on top of your debt reduction plan can be a struggle, especially when you’ve got a lot of different bills due at different times of the month.

Also, when you’re in the middle of the process it can feel like the end is nowhere in sight. But, staying motivated and organized is key if you’re going to see financial freedom.

Read MoreDo You Have Enough Insurance on Your Home? Here’s How to Know

Homeowner’s insurance is a “necessary evil” that comes with owning a home, especially if you have a mortgage.

You pay it every year, either as part of your mortgage or when the bill comes in the mail. But, God forbid, if you were to have a loss, would your policy be enough to cover what happened?

Read MoreWhy You Need a Home Inventory for Your Second Home

Owning a second home can be a great investment and source of relaxation, but it also comes with its own set of responsibilities such as creating a home inventory for your second home.

A home inventory is a detailed list of all your personal belongings, along with their value and other relevant information. Having a home inventory for your second home is just as important as having one for your primary residence.

Read More