There are different homeowner situations where it is important to financially plan all your future remodel projects. This process is when you list all your current and future remodel projects and establish budgets for the projects. This is regardless of whether you plan on hiring a contractor or doing-it-yourself (DIY).

A financial challenge exist when managing remodel projects. Many homeowners don’t have the funds to take on all projects at once and they get frustrated. So it is important to plan which project to do each year. Once you establish your project list, you can develop a budget per year for which projects you will perform. By planning over multiple years, you can also prioritize the projects that are important for you in each year.

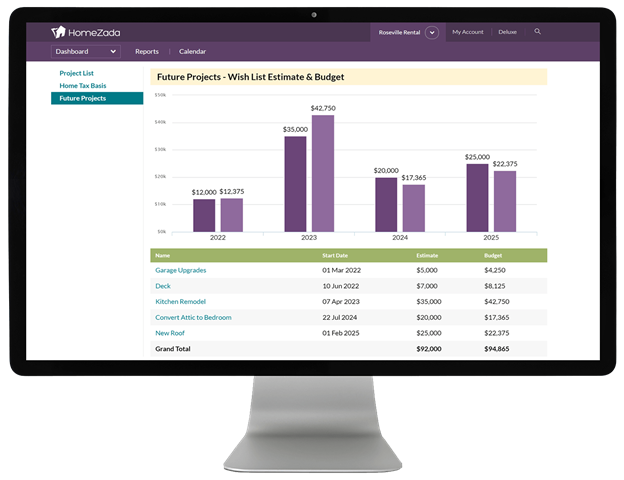

HomeZada released a brand new “Future Projects” report as part of the HomeZada Premium subscription. This report helps homeowners financially plan and prioritize their remodel projects. Homeowners can create a list of all their desired projects from HomeZada’s 50+ templates. HomeZada customers can then create budgets for all the items needed on a project. They can create a start date that reflects when and in which year the project will be performed. The screenshot below shows you how HomeZada combines all the information into an easy to view report.

This report gives you the ability to see the each year’s total project budget. It is a combined view with the list of projects over multiple years to help you plan your budgets year over year. It is easy to drill down into any project and change the future start date to move a project date either sooner or later depending on your priorities and annual remodel budget.

There are several types of homeowners that benefit from a report like this one.

First-time Homeowners

Many first-time homeowners and DIY enthusiasts buy homes that need a lot of remodel and renovation work. This is because these homes are cheaper than other neighborhood homes that are already in great shape.

As a result of buying a “fixer-upper”, there usually is a lot of remodel and renovation projects that include both major indoor lifestyle projects, exterior building material updates, and even larger scale landscape projects. Having a financial planning system to plan annual budgets along with a prioritized list of which projects to start is very important for these homeowner situations.

Aging in Place Home Remodels

Another scenario is for people who plan on aging in place within their current home. This usually happens to boomer or senior generations who have been in the current home for a long time. The list of projects they need to financially plan for include renovations that replace building materials that have reached the end of their useful life like roofs, HVAC equipment, and siding.

In addition, there are a number of safety and lifestyle projects for aging in place. This includes make the home safer for general use and access in bathrooms and the kitchen. It may also include access into the home and taking into account any specific medical devices and equipment the homeowner may need to install in their home.

Real Estate Investors

Consumers who invest in residential real estate for additional rental income often times have a number of renovations they take on. It is important for these investors to have a financial plan over how much additional investment beyond the original purchase price of they home they plan on making.

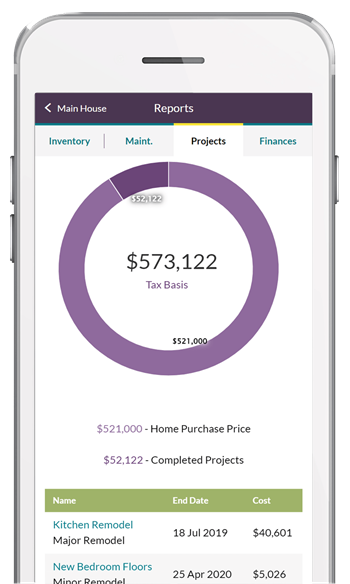

Maintaining and improving a rental property helps the investor increase rental income. This additional income has to be balanced by the quantity and costs of those renovations. So not only is planning for future projects important, but also keeping a history of all the project investments becomes important to track the properties’ tax basis which determines the tax situation when the house is sold.

Changing Needs with the Current Home

Many homeowners having changing needs and lifestyle goals with their current home. Major additions and renovations are often times trigger by a growing family that include children or even caring for elderly parents in your home. These projects include adding new bedrooms and bathrooms, finishing out basements, or creating living space in the attic.

Other times homeowners want to change their home for lifestyle reasons like working from home, working out from home, a passion for cooking with a larger kitchen, or increasing outdoor entertainment with friends and family. All of these scenarios require financial planning for which future project remodels you want to do.

Keep Records of Remodels Completed

Planning for future project remodels is very important. But as a reminder, it is equally important to keep records of all your previous projects that you have completed. When you decide to sell your home in the future, it is important to know what the tax basis is for your home which is the purchase price you paid plus all the home improvement projects you invested in your home.

HomeZada already has a “Tax Basis” report that shows you the purchase price of the home and all the completed projects along with the date and the summary of the total costs. This can be a huge tax savings because you will have to report how much you sold your house for and compare that to your tax basis to see if you owe any taxes. Having a higher tax basis that you can prove with all the documentation of your projects will help your tax situation. Check with your tax advisor for specific details to your situation.

Planning future remodel projects can be tricky, but with the right tools, you can evaluate and plan accordingly.

How To Prepare for a Home Remodel