The financial market constantly fluctuates, making the “rules” for how Americans should spend their money wisely change as well. When you’re planning to make a significant investment like buying a home, you must have a plan for saving enough money to cover a down payment, moving costs, closing costs, and all the minor emergency repairs that come with moving into a new home. The sooner you start implementing a strategy, the better off you’ll be. But if you’re not sure where to start, we’re here to help. Here are three key areas where you should put your discretionary income to ensure homeownership is in your near future.

Read More10 Signs its Time to Refinance

Perhaps you’ve thought about refinancing your mortgage, but you’re unsure whether or not it’s the right move. Maybe you’re asking yourself if it’s the right time, and wondering if rates will stay low, go lower or even begin to rise.

Truth is, sometimes it’s hard to know when to take the plunge.

Whether you bought a home recently or many years ago, you probably noticed that mortgage rates stayed near historic lows in early 2021.

Read MoreHome Management Made Easy

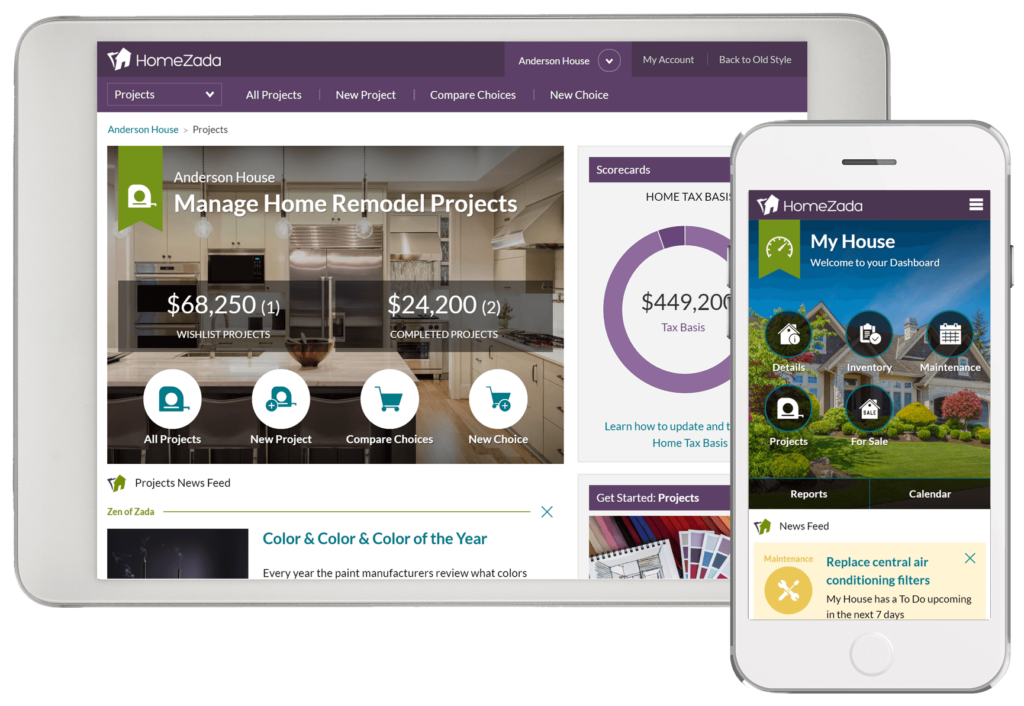

Have you ever wondered what it would be like to have the best tool possible to manage your home? We have the best tool you will need. It is not a hammer or screwdriver, not even a chainsaw. But is it is a digital home management platform that helps you track everything about your home in one central location. You may be asking what is a digital home management platform?

HomeZada gives you an website and a set of apps to track a home inventory, manage a maintenance calendar, leverage templates for home remodel projects, and review all home finances. Not to mention if you own multiple homes, you have one centralized location to track everything about your homes.

Read MoreKnow your home’s finances in one simple step with HomeZada

Most homeowners do not know the total annual cost to own their home. They don’t have a budget for insurance costs, property taxes, gas and electric bills, water and sewer costs, or other typical services like alarm costs, pest control, landscaping or cleaning cost. This causes financial uncertainty and stress in many homeowners lives.

Read MoreBudgeting for Rental Income with HomeZada

Many people have a second home that is a rental property. This rental property adds additional income to their personal finances. In addition, other people may have partial rental income from their primary residence through home sharing platforms like AirBnb.

Read More