Congratulations! You’re now the owner of a new (or new to you) home! Of course, you realize that your expenses have only just begun, even though you may have already bought your home, right?

I’m talking about home maintenance.

When putting together your budget as a new homeowner, remember to include the annual cost of this very important element of being a homeowner.

Wondering what’s included in yearly home upkeep?

First, there is routine maintenance like gardening, pest control, and small repairs (like fixing a leaky faucet). Along with your maintenance costs, you must include potential major repairs (like replacing the roof) in your budget.

Read on to learn 3 budgeting methods that will help you determine your annual home maintenance budget based on factors such as the cost, age, and size of your house, among other things.

How to Plan a Budget for Home Repairs

Keep in mind that the amount you need to set aside will differ from what you may have experienced before. Each home is different and will require a different cost for maintenance and repairs.

Although it’s impossible to predict your annual spending with accuracy, using these popular techniques will give you a general idea of how much you should put away in your savings account each month.

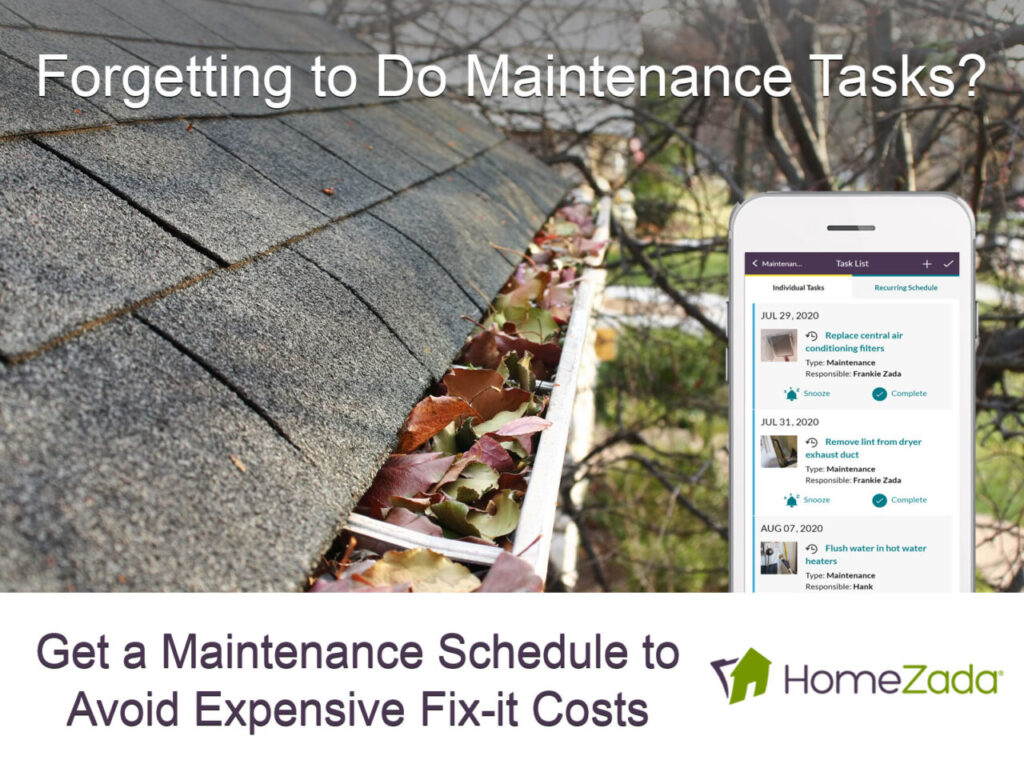

Home Maintenance Schedule & Checklist Software App | HomeZada

The 1% to 4% “Rule of Thumb”

The most popular approach to estimating home maintenance costs is to make the assumption that you’ll spend between 1 percent and 4 percent of the value of your home annually. For instance, if your home is worth $200,000, you should budget $2,000 to $8,000 per year for maintenance.

That spans a very broad range, of course. Your budget should fall somewhere between the low end of that range (1 percent of your home’s value) and the high end (4 percent of your home’s value), depending on a number of factors that will influence the cost of maintenance for your home.

For example, you can probably get away with setting aside something that’s closer to 1% of the value of your home each year if:

- ⬥ your home is 10 years old or younger

- ⬥ your location doesn’t freeze in winter, there isn’t a lot of rain, and the humidity isn’t too high

- ⬥ the size of your house is modest to average

- ⬥ if the home has been well cared for over the years

If any of the following apply, you should set aside close to 4% of your home’s value annually:

- ⬥ your house is more than 30 years old

- ⬥ your house is close to water or in a region with harsh weather

- ⬥ the size of your house is substantial (3,000+ square feet).

- ⬥ regular maintenance chores (like replacing HVAC filters, cleaning the gutters, or scheduling yearly roof inspections) have either been neglected by you or the previous owner.

Budget between 2 percent and 3 percent if your home has a mixture of these features or is in the middle of the pack. Remember that spending too much on home maintenance is preferable to spending too little.

The Square Footage Method

Using your home’s square footage is another “ballpark” method for calculating the general amount of money you should set aside for home maintenance.

You should set aside $1.00 for every square foot of your home, annually.

For instance, let’s say your new home is 2,500 square feet. If you were to use this method, the average annual cost of home maintenance would be $2,500.

Here’s how to apply this approach when calculating an annual home maintenance budget.

Take the square footage of the home and divide it by 12. Set that amount aside every month until you’ve accumulated what you’ll need for home maintenance costs.

For example, the calculation for a home that is 2,500 square feet in size would be around $208.00 per month.

This approach is very straightforward, making it simple to implement. However, it isn’t quite as accurate. The square footage method disregards elements like the age and location of your home. Additionally, it disregards the price of exterior services like landscaping and lawn care.

However, your home’s square footage can provide you with an approximation of your goal if you’re just looking for a general idea of how much to put into your savings account each month to cover home maintenance costs.

Ask the Prior Homeowner

Keep in mind that the cost of home maintenance varies depending on a variety of house-specific factors. The previous owner can provide you with a more thorough and precise estimate of the cost of maintenance than any of these calculations can.

If at all possible, discuss the repairs your home has required over the years and how frequently they were needed with the previous owner. This will help you estimate how often you’ll need to shell out cash for the same repairs in the future.

Obviously, you don’t want to base your budget on someone who neglected the requirements of maintaining a house in good condition, so this method will be effective only if the previous owner of your home was dependable in maintaining the home.

6 Home Finances You Should Be Tracking

Managing Your Home Finances for More Effective Home Management

5 Old-School Home Maintenance Routines to Secure your Property Value